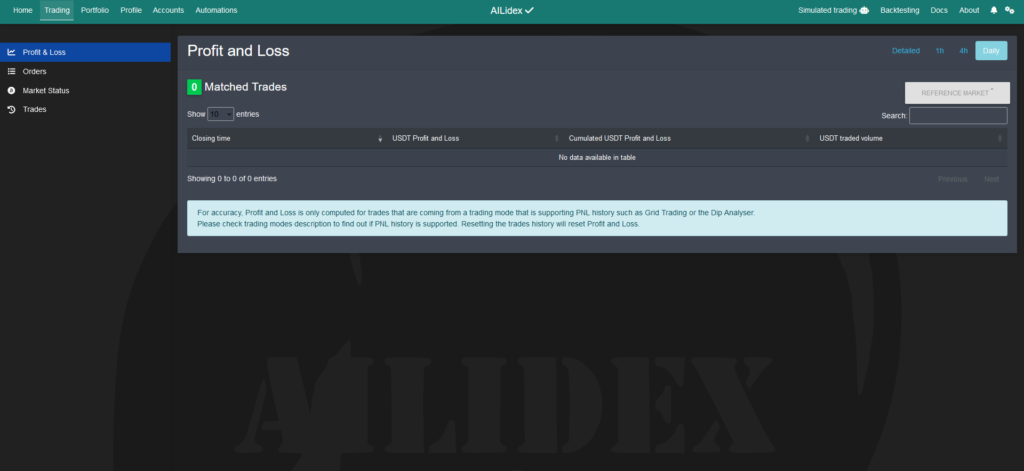

Trading

Profit and Loss (PNL) calculations are exclusively available for trades initiated from trading modes that support PNL tracking, such as Grid Trading or the Dip Analyzer. Refer to the trading modes descriptions to confirm whether PNL tracking is supported. Resetting the trades history will reset both Profit and Loss figures.

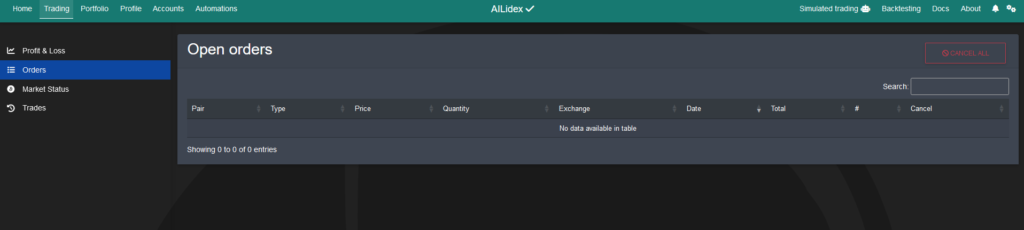

Open Orders

- What type of order to create

- How much money to put in each order and at what price

- How to take profit or stop losses

- When to cancel orders if a cancel is necessary

In AILidex trading bot, an “open order” refers to a trading order that has been placed but has not yet been executed. When you initiate a trade using the bot, it sends a request to the exchange to buy or sell a specific cryptocurrency at a particular price. Until the exchange matches this order with a corresponding buy or sell order from another trader, the order remains open.

Open orders are visible in the AILidex interface, allowing you to monitor the status of your trades in real-time. You can view details such as the cryptocurrency pair, order type (buy or sell), price, quantity, and time placed. Once an open order is executed and matched with a corresponding order on the exchange, it is considered “filled,” and the trade is completed.

Monitoring open orders is essential for traders to manage their positions effectively and make informed decisions based on market movements. AILidex provides users with comprehensive tools and features to track open orders, manage trading strategies, and optimize their trading experience in the cryptocurrency markets.

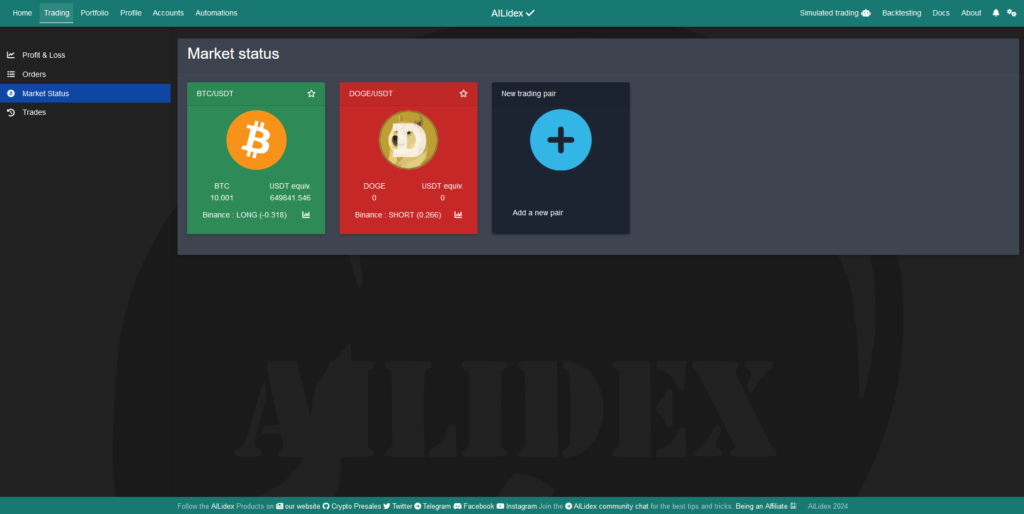

Market Status

Market Status makes us to understand our trading pair,

In the context of a crypto trading bot like AILidex, a “trading pair” refers to the combination of two different cryptocurrencies that can be traded against each other on a cryptocurrency exchange.

Cryptocurrency exchanges typically offer a variety of trading pairs, allowing traders to exchange one cryptocurrency for another. For example, in the BTC/ETH trading pair, Bitcoin (BTC) is the base currency, and Ethereum (ETH) is the quote currency. This means that you can trade Bitcoin for Ethereum, or vice versa, within this trading pair.

When configuring a trading bot like AILidex, you’ll specify which trading pairs you want the bot to monitor and trade within. The bot will then execute buy and sell orders based on your predefined trading strategy for the selected pairs.

Understanding trading pairs is essential for crypto traders as it determines the assets they can trade and the market they can participate in. Different trading pairs may have varying levels of liquidity, volatility, and trading volume, which can impact trading strategies and outcomes.

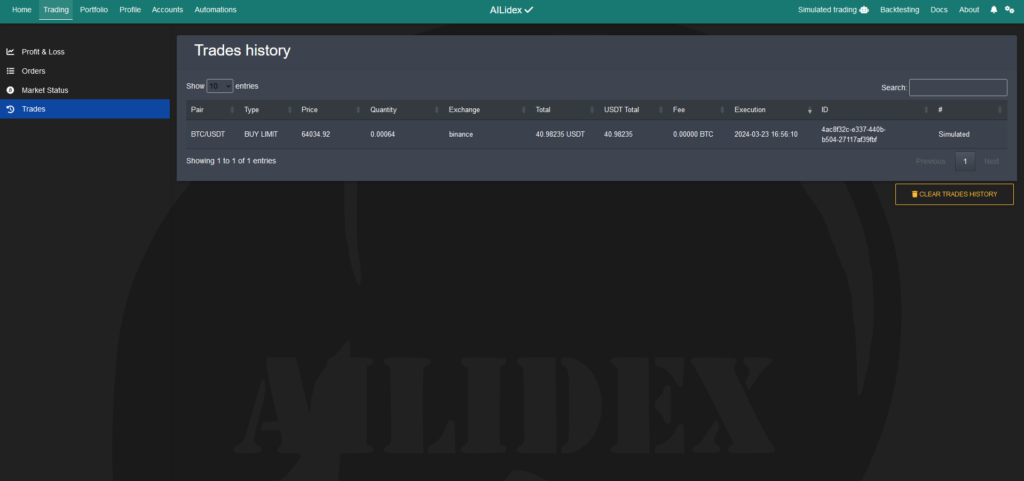

Trade History

Trade history and all orders made refer to the records of past trades and orders executed by a trading bot, such as AILidex, in the cryptocurrency markets. Here’s a breakdown of each term:

- Trade History: Trade history typically includes a log or record of all completed trades executed by the trading bot. It provides details such as the date and time of the trade, the trading pair involved, the type of trade (buy or sell), the price at which the trade was executed, the quantity of assets traded, and the total value of the trade. Trade history allows traders to review their past transactions, analyze their performance, and track their trading activity over time.

- Orders Made: This refers to a comprehensive list of all trading orders placed by the trading bot, including both open and filled orders. It encompasses orders that have been executed, orders that are pending execution, and canceled orders. Each order typically includes details such as the trading pair, order type (buy or sell), price, quantity, order status (open, filled, canceled), and time placed. By reviewing the list of orders made, traders can gain insights into their trading strategy, monitor the status of open orders, and adjust their trading approach as needed.

In summary, trade history provides a record of completed trades, while orders made encompass all trading orders placed by the bot, including both executed and pending orders. These records are valuable for traders to evaluate their performance, track their trading activity, and make informed decisions in the cryptocurrency markets.